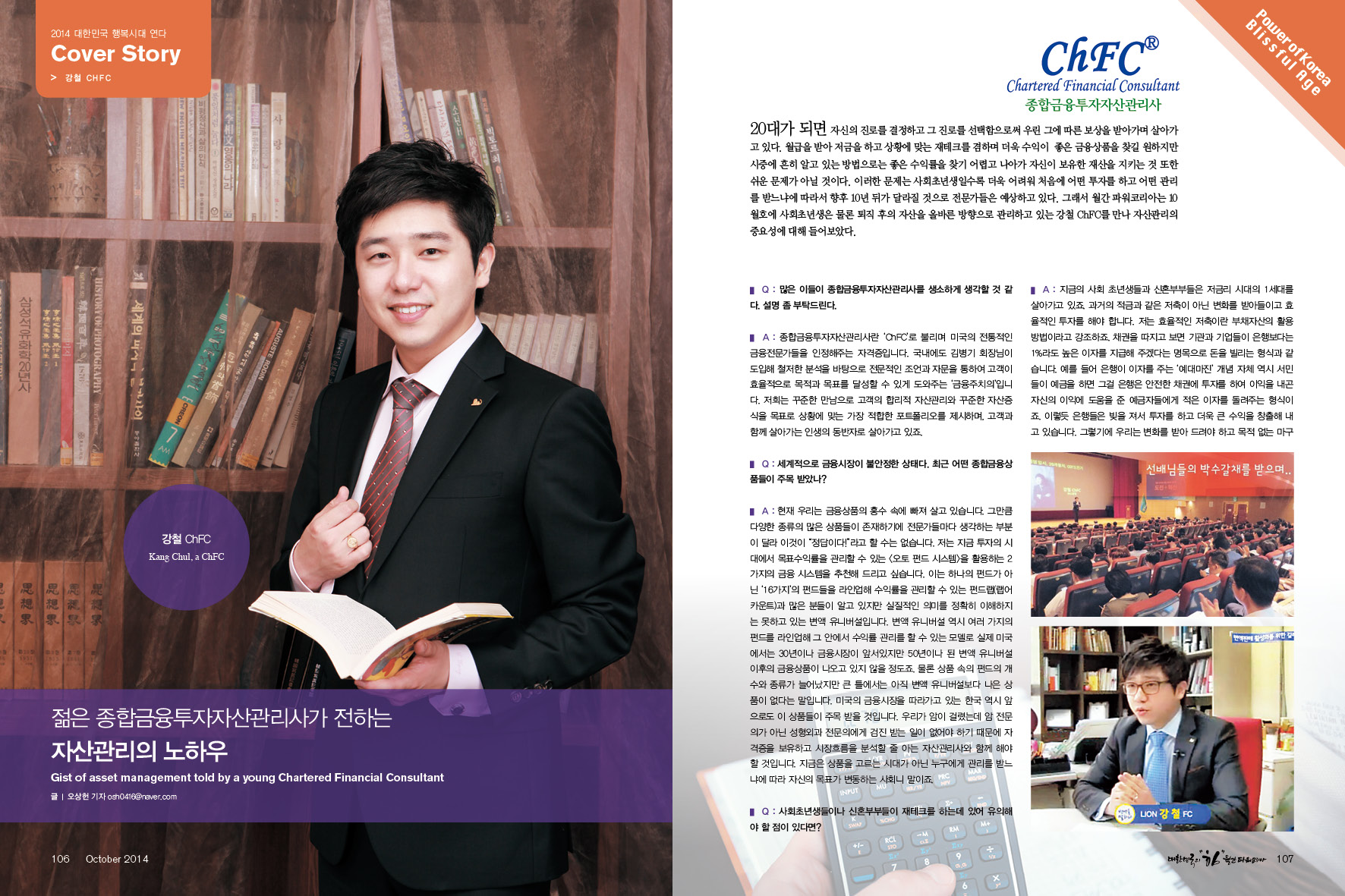

젊은 종합금융투자자산관리사가 전하는 자산관리의 노하우

강철 ChFC

20대가 되면 자신의 진로를 결정하고 그 진로를 선택함으로써 우린 그에 따른 보상을 받아가며 살아가고 있다. 월급을 받아 저금을 하고 상황에 맞는 재테크를 겸하며 더욱 수익이 좋은 금융상품을 찾길 원하지만 시중에 흔히 알고 있는 방법으로는 좋은 수익률을 찾기 어렵고 나아가 자신이 보유한 재산을 지키는 것 또한 쉬운 문제가 아닐 것이다. 이러한 문제는 사회초년생일수록 더욱 어려워 처음에 어떤 투자를 하고 어떤 관리를 받느냐에 따라서 향후 10년 뒤가 달라질 것으로 전문가들은 예상하고 있다. 그래서 월간 파워코리아는 10월호에 사회초년생은 물론 퇴직 후의 자산을 올바른 방향으로 관리하고 있는 강철 ChFC를 만나 자산관리의 중요성에 대해 들어보았다.

Q : 많은 이들이 종합금융투자자산관리사를 생소하게 생각할 것 같다. 설명 좀 부탁드린다.

A : 종합금융투자자산관리사란 ‘ChFC’로 불리며 미국의 전통적인 금융전문가들을 인정해주는 자격증입니다. 국내에도 김병기 회장님이 도입해 철저한 분석을 바탕으로 전문적인 조언과 자문을 통하여 고객이 효율적으로 목적과 목표를 달성할 수 있게 도와주는 ‘금융주치의’입니다. 저희는 꾸준한 만남으로 고객의 합리적 자산관리와 꾸준한 자산증식을 목표로 상황에 맞는 가장 적합한 포트폴리오를 제시하며, 고객과 함께 살아가는 인생의 동반자로 살아가고 있죠.

Q : 세계적으로 금융시장이 불안정한 상태다. 최근 어떤 종합금융상품들이 주목 받았나? A : 현재 우리는 금융상품의 홍수 속에 빠져 살고 있습니다. 그만큼 다양한 종류의 많은 상품들이 존재하기에 전문가들마다 생각하는 부분이 달라 이것이 “정답이다!”라고 할 수는 없습니다. 저는 지금 투자의 시대에서 목표수익률을 관리할 수 있는 <오토 펀드 시스템>을 활용하는 2가지의 금융 시스템을 추천해 드리고 싶습니다. 이는 하나의 펀드가 아닌 ‘16가지’의 펀드들을 라인업해 수익률을 관리할 수 있는 펀드랩(랩어카운트)과 많은 분들이 알고 있지만 실질적인 의미를 정확히 이해하지는 못하고 있는 변액 유니버설입니다. 변액 유니버설 역시 여러 가지의 펀드를 라인업해 그 안에서 수익률 관리를 할 수 있는 모델로 실제 미국에서는 30년이나 금융시장이 앞서있지만 50년이나 된 변액 유니버설 이후의 금융상품이 나오고 있지 않을 정도죠. 물론 상품 속의 펀드의 개수와 종류가 늘어났지만 큰 틀에서는 아직 변액 유니버설보다 나은 상품이 없다는 말입니다. 미국의 금융시장을 따라가고 있는 한국 역시 앞으로도 이 상품들이 주목 받을 것입니다. 우리가 암이 걸렸는데 암 전문의가 아닌 성형외과 전문의에게 검진 받는 일이 없어야 하기 때문에 자격증을 보유하고 시장흐름을 분석할 줄 아는 자산관리사와 함께 해야 할 것입니다. 지금은 상품을 고르는 시대가 아닌 누구에게 관리를 받느냐에 따라 자신의 목표가 변동하는 사회니 말이죠.

Q : 사회초년생들이나 신혼부부들이 재테크를 하는데 있어 유의해야 할 점이 있다면?

A : 지금의 사회 초년생들과 신혼부부들은 저금리 시대의 1세대를 살아가고 있죠. 과거의 적금과 같은 저축이 아닌 변화를 받아들이고 효율적인 투자를 해야 합니다. 저는 효율적인 저축이란 부채자산의 활용 방법이라고 강조하죠. 채권을 따지고 보면 기관과 기업들이 은행보다는 1%라도 높은 이자를 지급해 주겠다는 명목으로 돈을 빌리는 형식과 같습니다. 예를 들어 은행이 이자를 주는 ‘예대마진’ 개념 자체 역시 서민들이 예금을 하면 그걸 은행은 안전한 채권에 투자를 하여 이익을 내곤 자신의 이익에 도움을 준 예금자들에게 적은 이자를 돌려주는 형식이죠. 이렇듯 은행들은 빚을 져서 투자를 하고 더욱 큰 수익을 창출해 내고 있습니다. 그렇기에 우리는 변화를 받아 드려야 하고 목적 없는 마구잡이 저축이 아닌 효율적으로 돈을 쓰는 방법과 거기서 투자로 나아갈 수 있는 방법들에 대해 고민해 봐야 합니다.

Q : 금융주치의로서 고객들에게 가장 강조하는 부분이 있다면?

A : 인생의 성공을 위해 세 사람만큼은 꼭 옆에 두라는 말이 있습니다. 변호사와 의사, 그리고 자산관리사입니다. 하지만 사회는 변호사와 의사에 대한 교육은 많지만 자산관리사에 대한 교육은 실제로 가정, 학교, 사회 어느 곳에서도 이뤄지고 있지 않습니다. 어쩌면 그렇기에 현재 은퇴를 앞둔 세대들이 은퇴자금을 준비하지 못한 이유가 될 수도 있습니다. 그래서 저는 고객들에게 좀 더 어릴 때부터 금융에 대해 공부하고 자산을 관리하는 방법 등에 대해 알아가라고 전합니다. 지금의 사회초년생과 신혼부부들은 금융시장의 변화를 받아드리며 목적 없이 마구잡이 저축이 아닌 효율적으로 돈을 쓰는 방법부터 시작해 거기서 투자로 나아갈 수 있는 방법들에 대해 느끼라고 강조하고 있죠.

Q : ChFC로서 교육과 강의를 다닌다고 알고 있다. 어떤 강의들인가?

A : 최고의 자산관리사를 넘어 정확한 재무 설계와 자산관리에 있어 바른 방향과 마인드를 후배들에게 전해주는 최고의 강사가 되고 싶습니다. 그렇기에 동종 업계 분들을 대상으로 하는 강의에서는 앞으로 바라봐야 하는 금융시장의 변화와 업계의 비전을 강조하고 새롭게 시작하는 자산관리사들에게는 제대로 된 가치관과 동기부여적인 부분을 강의하고 있죠. 일반적으로는 사회초년생, 신혼부부들을 위한 세미나 위주의 자산관리와 재무설계에 대한 내용을 주로 강의하고 있습니다. 준비를 많이 해서 그런지 제 강의는 후배들 뿐 아니라 선배님들께서도 좋아해주시고 있죠. 이런 제 교육과 강의 내용들이 자신의 노하우와 접목해 더 좋은 재무설계와 관리 방법들을 터득했으면 합니다.

Q : 젊지만 업계에서 주목받고 있다. 자산관리사로서 향후 어떤 목표가 있나?

A : 단기적인 목표는 자산관리사로서는 고객이 한정적이어야 한다는 것이 제 생각입니다. 고객이 150명이 넘는 순간 영업을 끊어야 한다고 하죠. 앞으로 2년 안에 믿음과 신뢰로 함께 할 수 있는 150명의 동반자를 모시는 게 단기적 목표이며, 그분들과 함께 WIN, WIN하여 성공하신 동반자들을 두고, 그 이후 옆의 성공하신 분들과 함께 평생 300명의 자산을 관리하는 자산관리사로 살아가고 싶습니다.

우리는 살아가면서 ‘해야 할 일’과 ‘하고 싶은 일’이 있다고 합니다. 현재 사회초년생들은 이 차이를 모르기에 소비의 패턴에 너무 빠져있어 하고 싶은 일만을 하고 있죠. 하고 싶은 일만을 한다면 나중에는 꼭 해야 할 일을 하며 살아가야 합니다. 하지만 우리가 해야 할 일을 먼저 해둔다면 이후 하고 싶은 일만을 골라 할 수 있습니다. 그렇기에 자신의 큰 꿈을 그린다면 자산관리는 일찍부터 준비해야 하는 가장 중대한 부분이라고 전하고 싶습니다.

Gist of asset management told by a young Chartered Financial Consultant

Kang Chul, a ChFC

Q: There seem to be many people who may find the title of Chartered Financial Consultant unfamiliar. What is it?

A: Also called ChFC for short, it is a certificate to recognize traditional financial specialists in the US. Domestically, President Kim Byung-gi introduced the system and this means ‘a financial doctor’ who helps the customer accomplish his purpose and aim efficiently through professional advice and consultation based on thorough analysis. We present the most suitable portfolio for the customer’s situation for the sake of their rational asset management and its continued increment through a constant meeting with them. We are getting along with the customer as their partner in life.

Q: The financial market is globally in an unstable condition. Recently, what kind of investment bank products has been receiving attention?

A: Currently, we are in the flood of financial instruments. So many diverse kinds of product exist that each specialist emphasizes different aspects and maybe there is no exactly “right answer.” As for me, I would like to recommend two kinds of financial system using <Auto Fund System> because it enables you to control over target yields in this time and age of investment. One is the fund wrap (Wrap account) capable of lining up ‘16 kinds’ of fund, not one, to control over yields; the other is Variable universal, which many have heard of without exact understanding of its substantial meaning. Variable universal is another model in the lineup of many funds for management of yields within. In fact, even in the US with a 30-year-advanced financial market, there is no financial instrument coming out since the variable universal, which has existed for as long as 50 years. Despite the increased number and kind of funds in the instrument, this means a better product than variable universal has yet to come in a large frame. Korea is following up the US financial market so these instruments are sure to attract attention in the future, too. It is of no sense to get diagnosis from a plastic surgery specialist, not a cancer specialist, when we have cancer, so it is better to be with a chartered financial consultant who knows how to analyze the market forces. This is not the age of choosing a product but one in which one’s aim varies depending on from whom he receives management.

Q: What should the new employees or newlyweds take care of in their attempt to increase property?

A: They are the first generation living in the age of low deposit interest rates. They should accept a new concept of deposits different from the past installment savings and make an efficient investment. I emphasize that efficient savings is the use of loan property just like a bond is the form in which institutions and enterprises borrow money in the name of paying interests even one percent higher than the banks. For example, the concept of ‘spread’ is the form of the bank investing the deposit money from common people in safe debentures, making a profit, and then returning a few interests to depositors who have contributed to their earnings. Like this, banks are making investments by running a debt and then creating even more profits. Therefore, we need to accept the change and trouble over how to use money efficiently rather than random savings and proceed to investment hereafter.

Q: What do you emphasize to customers as a financial doctor?

A: There is a saying that you should keep three persons at your side for success in life: lawyer, medical doctor and financial consultant. However, there are many instructions for lawyers and medical doctors, but actually no instructions going on for financial consultants at home, school or any place in the society. Probably, this might be the reason that the current generation with retirement ahead has failed to have the retirement fund ready. That is why I emphasize to customers studying finance and finding ways to manage their property while they are still young. To the current new employees and newlyweds I emphasize accepting the change in the financial market and starting with how to use money efficiently, rather than random savings, followed by finding ways to proceed to investments.

Q: I hear you are giving instructions and lectures as ChFC. What sort of lectures?

A: I want to be one of the best lecturers who can deliver the right direction and mindset for exact financial design and asset management, not just an excellent financial consultant. So, in lectures to people in the sane industry, I emphasize the change in the prospective financial market and vision of the industry while to beginner financial consultants, I am telling about the right values and their proper motivation. More generally, I am giving lectures on asset management and financial design in a seminar style to new employees and newlyweds. Maybe with lots of preparation, my lecture is liked by seniors as well as juniors. I hope the content of my instructions and lectures will be combined with the attendees’ own knowhow to help them catch on better financial design and method of management.

Q: Though young, you are attracting attention from the industry. Do you have any future goal as a financial consultant?

A: For a short-term goal, I think a financial consultant should have a limited number of customers. They say business must be stopped when one’s customers exceed 150 in number. My short-term goal is to gather 150 partners to share trust and confidence within two years ahead and make win-win with them producing successful partners. With these people, I would like to lead a life as a financial consultant who will manage over the assets of 300 people.

They say we have ‘things to do’ and ‘things in my wish’ in life. The current new employees who are not aware of this difference are just doing things in their wish, engrossed in the pattern of consumption. If one carries out only what he wishes to do, he must get along by doing what he absolutely needs to do afterwards. On the other hand, if we do what we need to do first, we will be able to do later what we want to do by choice. Therefore, if one has a big vision, I would say that asset management is the most important part in life that must be prepared early enough.

진경호